$2 Trillion, or 70%, Pandemic Wealth Gain of Nation’s 740 Richest May Well Go Untaxed, Making Case for President Biden’s Proposed Billionaires Income Tax

A Similar Tax Proposed by Senate’s Chief Tax Writer Would Reap Up to $555 Billion to Lower Working-Family Costs for Healthcare, Childcare & Other Vital Services

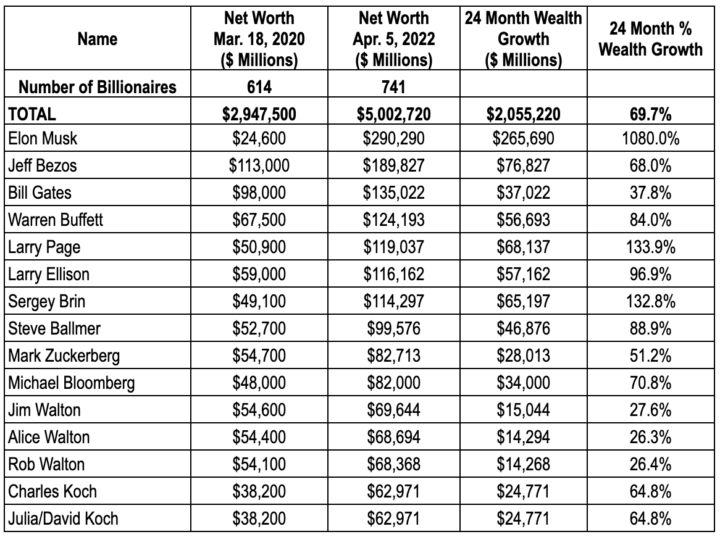

On Tax Day, April 18, 2022, working families are once again paying their fair share and billionaires are not. American billionaires saw their collective net worth climb by $2 trillion, or 70%, during the first two years of the pandemic to a staggering $5 trillion, according to Forbes data analyzed by Americans for Tax Fairness (ATF). [See table below and all data here] But none of that wealth growth—the main source of billionaire income—may ever be taxed.

The total number of U.S. billionaires increased from 614 to 741 over the two-year period from March 18, 2020, to April 5, 2022. Among the notable increases in wealth:

- Elon Musk: The driving force behind Tesla and SpaceX saw his wealth skyrocket over 11-fold, or $266 billion, to land at $290 billion.

- Jeff Bezos: The man who started Amazon is now worth nearly $190 billion, after a $77 billion leap in wealth over the last two years.

- Larry Page and Sergei Brin: The Google co-founders saw their wealth climb more than 133% – and are now worth $119 billion and $114 billion, respectively.

Loopholes often allow billionaires to pay little or no federal income tax. An expose last year by ProPublica based on IRS data revealed that Elon Musk, Jeff Bezos and other top billionaires paid zero federal income tax in several recent years. It determined that the top 25 billionaires paid just a 3.4% tax rate between 2014 to 2018 when the growth in their wealth is counted as income. White House economists have determined the nation’s 400 richest billionaires paid a tax rate of only 8.2% over a recent nine-year span when the increased value of their corporate stock was counted as income. The average federal income-tax rate for all taxpayers was 13.3% in 2019.

Billionaires and other very wealthy people overwhelmingly generate income not from a job or small business, but from the growth in the value of their investments. But that form of income is never taxed unless the investments are sold. Yet the very wealthy do not need to sell their assets to turn the increasing value of their wealth into cash income; instead, they use their swelling fortunes to secure special low-interest loans allowing them to live lavishly without paying income taxes. Moreover, a lifetime of such income growth from assets can be passed onto the next generation tax-free.

Source: Forbes data from March 18, 2020, and April 5, 2022, analyzed by Americans for Tax Fairness and available here.

Congress can close this massive tax loophole through a billionaires income tax, such as recently proposed by President Joe Biden and last year by Sen. Ron Wyden (D-OR), the Senate’s chief tax writer. A comparison of the two proposals is available here.

Both proposals would tax investment gains of the superrich more like the wages of workers are taxed now. Requiring billionaires to pay a fairer share on the growth in value of their assets would make the tax system more equitable and generate revenue that would greatly benefit the economy and increase services and opportunities for millions of Americans.

“The failure to tax increases in billionaire wealth from skyrocketing corporate stock and other investments is the worst loophole in our loophole-ridden tax code. Workers pay tax on their income all year, every year. Simple justice demands that billionaires do the same,” said Frank Clemente, executive director of Americans for Tax Fairness. “Congress should close this loophole as part of the legislation members are now negotiating to help families cope with rising prices and make major investments in clean energy, all paid for by more fairly taxing the rich and corporations.”

President Biden’s Billionaire Minimum Income Tax would raise $360 billion over 10 years exclusively from the richest 0.01% of Americans, each worth at least $100 million. The Billionaires Income Tax proposed by Sen. Wyden would raise $555 billion over 10 years from about 700 billionaires.

Revenue raised from a billionaires income tax could help lower costs paid by America’s working families for necessities like healthcare, childcare, education and housing; and make other crucial public investments, such as in the effort to avert climate catastrophe. Based on cost estimates from the House-passed Build Back Better Act, these are among the investments and combinations of investments that could be funded by the President’s $360 billion plan:

- Over six years, cut childcare costs ($274 billion) and guarantee universal free preschool ($109 billion)

- Offer paid family leave ($205 billion over 10 years) and an expanded Child Tax Credit ($159 billion for one year)

- Over 10 years, reduce costs of housing ($151 billion) and eldercare ($150 billion), and expand Medicare to cover hearing benefits ($37 billion)

Senator Wyden’s $555 billion plan could pay to:

- Lower the costs of healthcare ($400 billion) and housing ($151 billion) over 10 years.

- Expand the Child Tax Credit ($484 billion over four years)

- Make clean energy investments ($555 billion over 10 years)

The public overwhelmingly favors a billionaires income tax: 64% of respondents in a recent national poll supported Senator Wyden’s plan. (Biden’s plan was not tested in this poll.)

This billionaires’ bonanza has played out against the pandemic pall: 80 million Americans have contracted COVID-19 and nearly one million have died from it. Many small businesses have closed, daily life has been disrupted and the cost of everything from housing to gas has consumed a greater share of household incomes. Although prompt and ample federal action prevented much worse economic consequences from COVID and helped to speed recovery, businesses and families will once again face perils as many of these interventions expire shortly.

Millions of families, for instance, could face steep increases in healthcare premiums or loss of insurance coverage in the second half of this year as pandemic responses fall away:

- Medicaid Coverage: Early in the pandemic, as millions of Americans lost jobs and healthcare coverage, Congress passed the bipartisan Families First Coronavirus Response Act that covered many more people. The federal government increased matching funds to states and ensured that Medicaid enrollees would be continuously covered through the duration of the public health emergency despite income fluctuations or other factors that would ordinarily disqualify them. Once the public health emergency expires—which it is expected to do this year—as many as 13 million people could lose health coverage over the next 12 months, according to an Urban Institute study.

- Affordable Care Act (ACA) Coverage: Congress and the Biden Administration also took action to make private insurance more affordable during COVID by passing the American Rescue Plan, which provided enhanced premium assistance to help more people buy ACA coverage. This resulted in record high enrollment in insurance marketplace plans this year. However, the enhanced premium assistance that saved individuals over $800 last year, will expire at the end of 2022 if Congress does not take action. This will price millions nationwide out of coverage.

- Closing the Medicaid Coverage Gap: The ACA greatly expanded Medicaid, the low-income insurance program jointly funded by the federal government and the states. Washington induced states to participate in this reform (the Supreme Court ruled it could not be required) by temporarily funding the entire expansion, with the ratio declining in recent years to a permanent 90-10 federal-state funding formula. Yet at the outbreak of the pandemic, a dozen states still had not expanded their programs. This left millions of Americans in “the Medicaid gap”: ineligible for traditional Medicaid but unable to afford even subsidized ACA coverage. COVID relief measures in 2020 and 2021 temporarily closed the Medicaid gap.

Continuing affordable healthcare coverage for millions of America’s working families would cost about $50 billion a year. That cost could be covered by Sen. Wyden’s tax on just the nation’s 700 or so richest households.

“It’s time to get our priorities straight. No one in our country, no matter where they live or how much money they have, should lose healthcare because they can’t afford coverage while billionaires get richer and avoid paying any taxes toward supporting the economy,” said Margarida Jorge, Executive Director of Health Care for America Now.

Citizen activists are calling on their members of Congress to take a position on increasing taxes for billionaires through the enactment of a billionaires income tax like those proposed by President Biden and Senator Wyden. As Congress prepares to debate a package that will include some tax increases for the wealthy, voters are asking members to endorse a resolution calling for billionaires to pay their fair share.

Proposals to create a billionaires income tax represent a historic change in direction away from decades of proliferating tax breaks and wider loopholes for the wealthy that have contributed to a growing wealth gap between the nation’s richest families and everyone else. President Trump’s 2017 Tax Cuts and Jobs Act (TJCA), the last major tax legislation passed by Congress, provided $1.9 trillion in tax giveaways mainly to the rich and corporations.